বাংলাদেশ জাতীয় তথ্য বাতায়ন

সর্বশেষ হালনাগাদ: November 22nd, 2022

নোটিশ বোর্ড

খবর

মুজিব বর্ষ কর্ণার

- কর্মপরিকল্পনা

- কার্যবিবরণী

- কমিটিসমূহ

- ফোকাল পয়েন্ট

আপিল দায়ের সংক্রান্ত

- আপিল ফর্ম

- আপিল দায়েরের নিয়ম

- আপিল ফি/জমা

- অন্যান্য

বার্ষিক কর্মসম্পাদন চুক্তি

সেবা প্রদান প্রতিশ্রুতি (সিটিজেনস চার্টার)

ই-গর্ভন্যান্স ও উদ্ভানী কার্যক্রম

বিজ্ঞপ্তি/আদেশ/পরিপত্র

ভিডিও গ্যালারী

মাননীয় অর্থমন্ত্রী

মাননীয় অর্থ প্রতিমন্ত্রী

সিনিয়র সচিব

প্রেসিডেন্ট

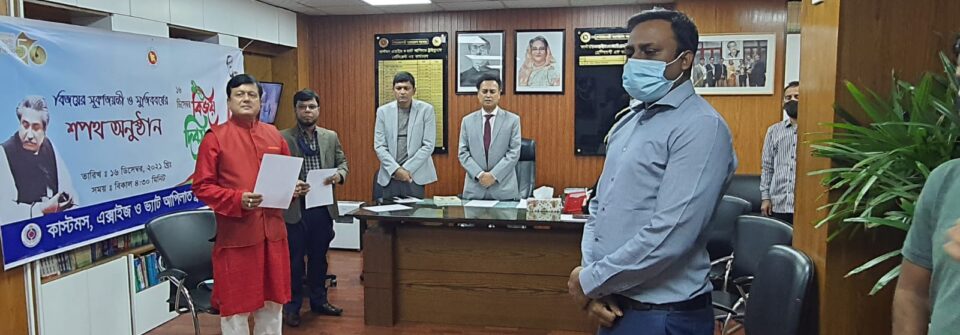

ড. মোঃ মতিউর রহমান

কাস্টমস, এক্সাইজ ও ভ্যাট আপিলাত ট্রাইব্যুনাল

(সদস্য, জাতীয় রাজস্ব বোর্ড )

গুরুত্বপূর্ণ লিংক

অভ্যন্তরীণ ই-সেবা

কাস্টমস, এক্সাইজ ও ভ্যাট আপীলাত ট্রাইব্যুনাল এর অবস্থান

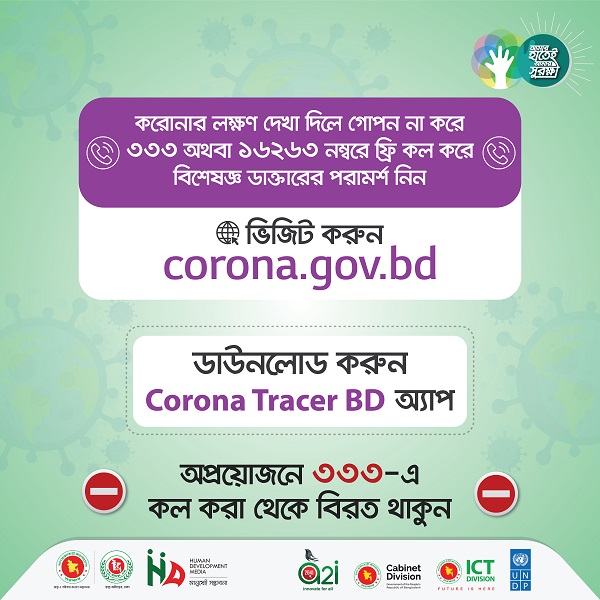

জরুরি হটলাইন

জাতীয় সংগীত

ডিজিটাল বাংলাদেশ দিবস ২০১৯ – সংগীত ভিডিও

পাবলিক সেক্টর ইনোভেশন একটি দেশের রূপান্তর

ডেঙ্গু প্রতিরোধে করণীয়

.png)